The NewSpace industry is rapidly growing. To unpack the changes going on in the industry we spoke to Harriet Brettle, the Head of Market Analysis and Business Intelligence at the European Space Agency, on Episode 19 of The Satellite & NewSpace Matters Podcast. Harriet is responsible for the analysis of markets relevant to the satellite communications and space solutions markets, giving her some excellent insights into the way the industry is developing. Here’s what she said:

Is there anything that’s particularly exciting you about the industry at the moment?

One of the things I really enjoy about working at the European Space Agency is the breadth of opportunities I have to look at within the space sector. One day I might be looking at understanding the potential of optical communications and how that can transform the satellite industry. The next day, I could be looking at how we can use satellite communication for disaster responses. The day after that I could be considering a completely different question that we haven’t even thought about. The variety of areas that we work with is what really hits home. For me that’s the role that space plays in everyday life. Our industry isn’t sitting in isolation, it’s incredibly connected to and impactful for the rest of the world. I’m excited to be working in the satellite communications area. Understanding the role that satellite communications plays is something I really enjoy.

What are you most excited to see in the future of the satellite industry?

Change is the only certain thing, right? That couldn’t be more true for the SATCOM sector at the moment. We’re seeing huge market changes. We’re also seeing how satellite operators and the space industry are reacting to all of that market change too. I don’t want to predict the future because we’re always wrong in some way, but I’m really excited to see how things are going to play out. We’re in a very disruptive, exciting time for SATCOM so I’m looking forward to seeing the innovative ways that new and existing players are going to take on those new challenges.

Do you think there is enough demand to sustain all of the players currently looking to enter the market?

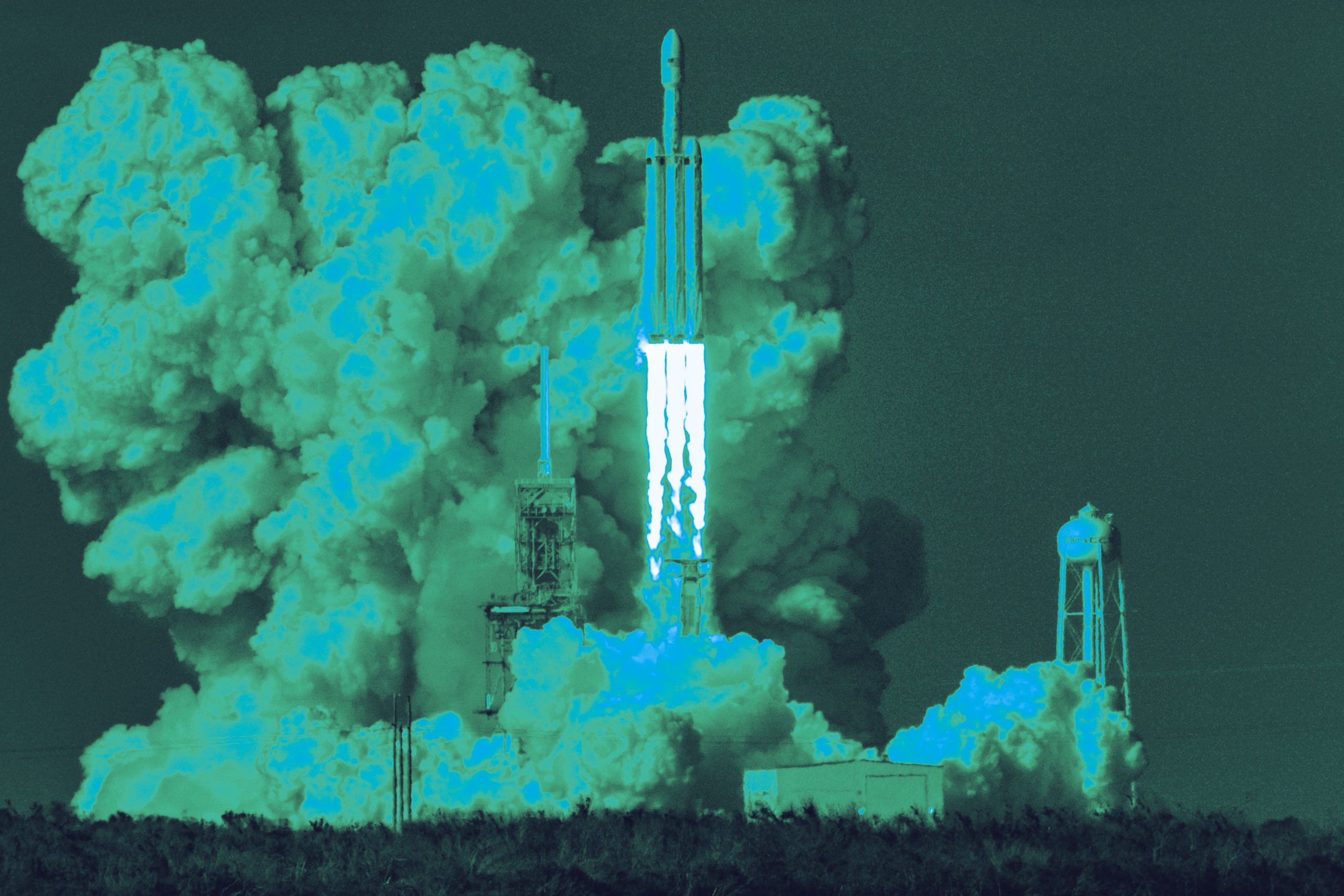

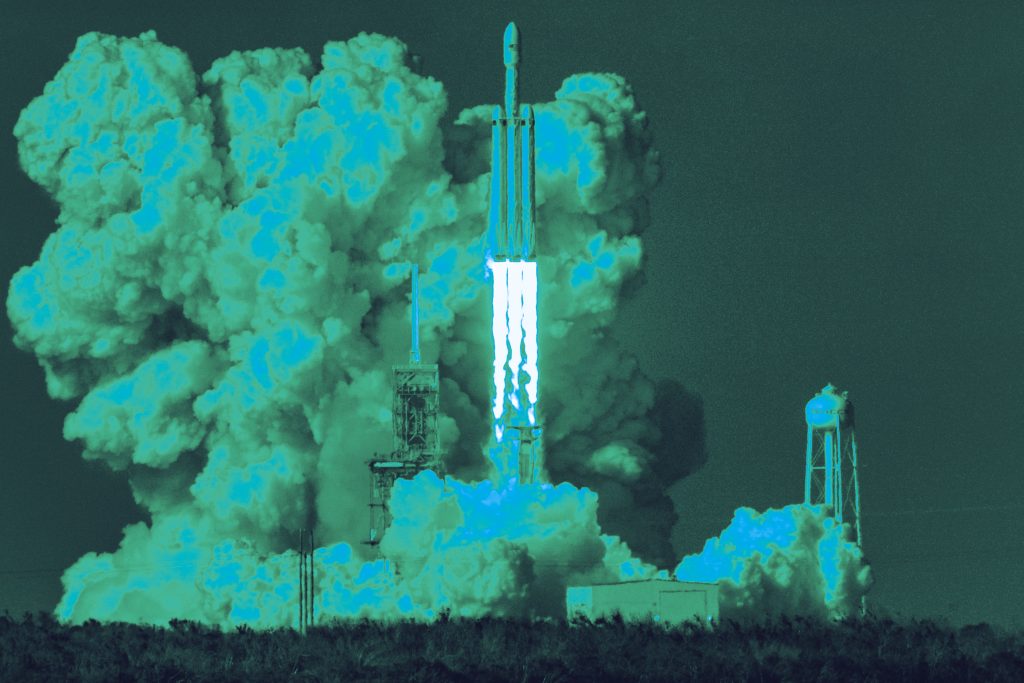

We’re seeing a whole host of new actors come in and disrupt the market. They also say history repeats itself, right? This isn’t the first time we’ve seen a wave of satellite constellations come onto the market, but I think it is different this time. There are a few things that are driving that. One is timing. In terms of where the smallsat technology is now, we’re now seeing launches at a cadence we couldn’t have even imagined just a few years ago. The scale at which we’re able to deploy satellites and the amount of funding that is going into the space sector is phenomenal.

It’s not just the amount of funding that’s going into particular companies. Jeff Bezos has said publicly that he’s planning to sell a billion dollars of Amazon stock every year to fund Amazon’s project Kuiperthe, which is a great example. That’s the kind of funding that most startups could only dream of. There’s a huge amount of focus on Starlink, but we’re still to see those business cases close. It’s one thing to get the constellation up in orbit, it’s another thing to be able to sell those services at a price point customers are willing to pay.

We’re also seeing projections for huge increases in the demand for data going forward. From the new conversations around LEO we’re also expecting to see a huge influx in capacity and supply coming onto the market as well. Satellite operators are able to charge to realise that opportunity. I don’t think it’s a slam dunk, but I think we’re seeing a huge amount of progress from a number of different operators, which is very exciting.

To learn more about the state of the NewSpace industry, tune into Episode 19 of The Satellite & NewSpace Matters Podcast here.

We sit down regularly with some of the biggest names in our industry, we dedicate our podcast to the stories of leaders in the technologies industries that bring us closer together. Follow the link here to see some of our latest episodes and don’t forget to subscribe.